Fiscal Year 2009: A Third Of Your Tax Dollars Finances Wars

April 15 is right around the corner, and according to the National Priorities Project from each income tax dollar collected by the Federal government 26.5 cents was spent on the military in 2009, and 13.6 cents was spent to pay for military and non-military interests on the sky rocketing national debt, which currently amounts to $12.6 Trillion. In comparison, only 2cents from each tax dollar was spent on education.

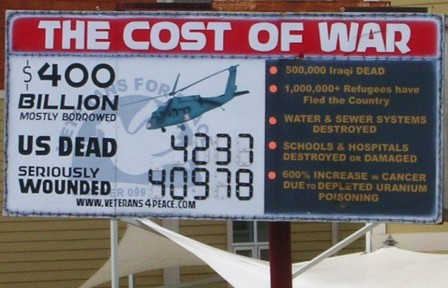

For the average American taxpayer, the personal cost of the wars in Iraq and Afghanistan since 2001 is more than $7,300 according to the National Priorities Project (NPP). The NPP has created a cost of war counter, this counter will shock you, make you feel dizzy, and hopefully push you to loudly voice your disapproval on policies that are utterly insane, and are still currently bankrupting the US economy.

According to the NPP, the wars in Iraq and Afghanistan have cost Americans collectively almost $1 Trillion, and still rising fast. The war in Afghanistan alone is about to hit the $300 Billion mark very soon. In comparison, that $300 Billion could have paid for health care for 131,780,734 American children for a year, or for 53,872,201 students to receive Pell Grants of $5,550, or for the salaries and benefits of 4,911,552 elementary school teachers.

In fiscal year 2009, the Federal government financed over half- 57 cents of each dollar of the $2.7 Trillion budget-through borrowing. Since 1940, the amount of money borrowed by the Federal government has varied from 73 cents of each dollar in 1943 to o for the fiscal year 2000.

The United States national debt, currently at $12.6 Trillion, is the total of annual deficits accumulated since 1940. Prosaically, there are only two ways to reduce the national debt; the first one is to decrease spending, the second one is to increase revenues. In fiscal year 2009, individual income tax payments contributed 6.6 times more than corporate taxes to federal revenues. In comparison, 30 years ago, individual income tax revenues were 3.3 times greater than corporate contributions to federal revenues. In other words, in fiscal year 2009, individuals contributed $915 Billion to the $2.7 Trillion total federal fund while corporations only contributed $138 Billion.

Obviously, if US politicians, both Republicans and Democrats, were truly concerned about fiscal responsibility they would look into cutting the biggest expense in the federal budget, which is of course the astronomical military expenditure. However, the Obama administration has made it perfectly clear that they have no intention to cut military spending anytime soon. Meanwhile, as you are struggling to keep your job (if you have one), and a roof above your head you can be assured that your tax money is “hard at work” in Afghanistan and Iraq.

To find out more about where your tax money is going click here.

Related Articles

You must be logged in to post a comment Login