Austerity: Setting Up Europe for a Mega May 1968 Redux

Europe’s governing financial technocrats are working to preserve a financial system that is, in the best case scenario, edging towards a severe recession or, in the worst case scenario, on the brink of a collapse. Regardless, European leaders are setting themselves up for a hot spring, which will undoubtedly shore up the ranks of the growing Occupy movement. It is unlikely that the populations of European countries will swallow willingly the harsh medicines concocted by the likes of Chancellor Merkel, President Sarkozy, loner Prime Minister Cameron in the UK, the European Central Bank and the IMF.

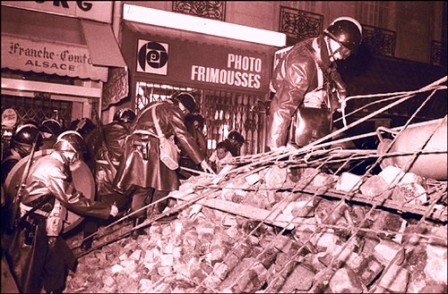

Last summer, Britain was engulfed by riots in the very heart of London for more than a week. Even though the riots were provoked by police brutality and racial tensions, they were a symptom of a wide discontent and of a deeply rooted social malaise. Europe’s leaders are focusing their attention on budget deficits, credit ratings and short-sighted economic concerns. By doing so, they are seeing just one tree and not the forest, and they are committing enormous mistakes in a desperate attempt to shore up a castle made of sand. On one hand widening deficits are forcing more borrowing from EU governments but, in a blatant contradiction, on the other hand the austerity measures, once fully implemented, will put economic growth even further out of reach.

In Germany, Chancellor Merkel had a gloomy New Year’s Eve forecast for the EU. Merkel said that “Europe was facing its harshest test in decades” adding that 2012 “Will no doubt be more difficult than 2011.” Merkel is now setting up the tone in Europe, and her pessimistic forecast was echoed in Italy and Greece by the two financial technocrats in charge: Prime Ministers Monti and Papademos. Indeed, the economic picture is bleak for Europe, and most economists, on both sides of the Atlantic, are forecasting a recession for 2012.

France’s good credit rating could be downgraded as early as mid-January, and this will unquestionably push the government to implement drastic austerity measures similar to those in the works in Greece, Italy, and Spain. However, France has a long and solid tradition of revolution and protests, and no matter which French parties try to implement unpopular measures, French people will take their anger to the streets. Europe, at large, by sticking to its overall austerity plan, is rejecting the Keynesian economic stimulus approach favored by the United States since the 2008 global financial crash.

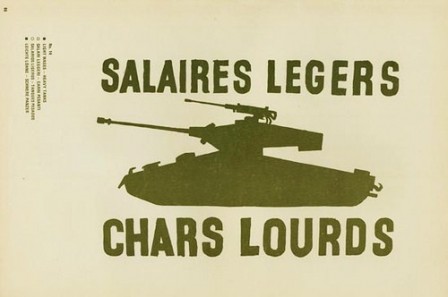

Under the impulse of Merkel, every government in Europe is imposing belt tightening measures of spending cuts, especially in social programs, and of property tax and income tax increases. By doing so, European governments are bending backwards to send a reassuring message to the masters of the universe who control the financial markets. On Friday, Spain announced a larger than expected budget deficit for 2011. And on January 9, the two lead EU players, Merkel and Sarkozy, will try to set up a new treaty that imposes tight budget requirements on all EU members.

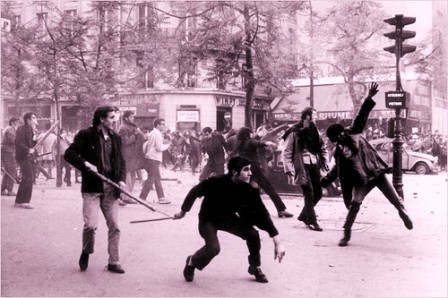

Naturally, the austerity measures across Europe will have the side effect of fueling the Occupy movement. If 2011 was the year of the Arab Spring, and in the United States the year of Occupy Wall Street, Europe could very easily become a new center stage of social unrest that will make the events of May 1968 look pale in comparison. May Day 2012 is an Occupy benchmark, and it is likely to get European governments’ attention.

Related Articles

You must be logged in to post a comment Login