Haiti’s Gold Rush: An Ecological Crime in the Making

Show me a corporate boss who calls Haiti the “poorest country in the western hemisphere,” and I’ll show you a con artist preparing to fleece Haiti. Likewise, show me a western technocrat who bemoans Haiti’s “dramatic deforestation due to charcoal production” and I’ll show a bio-pirate or vandal preparing to wreck the country’s remaining cloud-forest and mangrove-forest ecosystems.

It turns out that the real plan for Haiti’s northeastern region — especially the Caracol Bay area — is one that was hatched by U.S. and Canadian mining corporations, with the U.S. and South Korean sweatshop zone being a side project and distraction. If this mining plan is given a green light while Haiti is under foreign occupation, it will permanently strip the country of much of its mineral, cultural, and ecological wealth.

In a May 1, 2012 interview with Canada’s Financial Post, Majescor Resources Inc. CEO Dan Hachey was effusive about Michel Martelly’s installment as president because he expects Martelly’s policy of mimicking the Dominican Republic (DR) to be a boon to the mining sector. Hachey enthusiastically noted that “thirty years ago, there was no mining sector to speak of in the Dominican Republic…. In that short period of time they’ve seen the development of the Pueblo Viejo Project [of Barrick and Goldcorp’s], which is one of the world’s largest gold deposits — and is pretty much a neighbour of ours…. They’re going to be coming on with production this year.”

This glowing picture omits the fact that Barrick and Goldcorp have come under strong popular opposition in the DR. In a country where 20 percent of the population lacks access to drinking water, these companies are accused of polluting 2,500 cubic meters of water per hour with the vast quantities of cyanide needed to process 24,000 tons of ore a day by opencast (or open-pit) mining. Open-pit mining is banned by the European Union. Activists in the DR have joined forces with a broader group called Observatorio de Conflictos Mineros de América Latina (OCMAL) that launched a campaign to end this practice in the region. These problems are compounded by the damages from the more intense tropical storms due to climate change. For example, in the Philippines, the largest gold mine had to be suspended due to an unexpected spillage of waste into a major river. In the DR, there is great concern that the country’s biggest water reservoir, which is close to the mining operations, is continuously at risk of cyanide contamination, since stories of spills and massive fish die offs caused by mining companies are legion. Barrick and Goldcorp have also been accused of dynamiting mountains and destroying Taino Indian archaelogical sites.

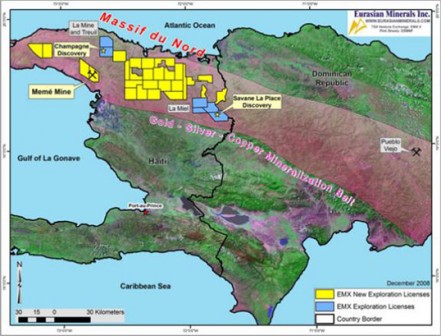

Like the Pueblo Viejo region of the DR currently under exploitation, the spot being eyed for mining by Majescor in Haiti — a 50-square-kilometer area called the SOMINE property — belongs to a broader region, replete with archeological sites, situated along a metal-rich mountain ridge running from southeastern DR to northern Haiti. This was formerly known simply as Le Massif du Nord but has become the “Massif du Nord Metallogenic (or Mineralization) Belt.”

The Haitian government and an EMX-Newmont joint venture signed a memorandum of understanding (MOU) in April 2012. A gold prospecct called Savane La Place was picked as the first project for drilling by this MOU, which allows exploration drilling while a mining convention is being ratified to permit development.

SOMINE is an acronym for Société Minière du Nord-Est S.A. and is described in the mineral trade sheets as a “Haitian affiliate mining company.” It is 66.4 percent owned by Majescor, with the rest being owned by unidentified members of Haiti’s elite. Majescor is still a relatively small company that conducts mineral surveys. The SOMINE property is surrounded by other mining properties owned jointly by Majescor and much larger concerns like the Vancouver-based Canadian company Eurasian Minerals Inc. (EMX) and the Colorado-based US company Newmont Ventures Ltd. Once Majescor’s surveys are complete, it plans to find a big partner, like EMX, Newmont or Barrick (or some partnership of these like EMX-Newmont), to handle the extractive part of the project.

Curiously, the area of the SOMINE property was initially surveyed as early as “the 1970s by the UN Development Program, with some very good results [but the project was not pursued. Then] there was a feasibility study done by the Germans [Bundesanstalt fur Geowissenschaften und Rohstoffe (BGR)] in 1980, and there was further drilling done in the 1990s by Canadian junior [mining companies],” recalled Hachey. During the 1980’s, the area was explored again by the UNDP and also surveyed by the French Bureau de Recherches Géologiques et Minière (BRGM), both of which reported finding only copper. The official story is that an abundance of copper had until 2012 obscured the fact that the area’s ore is also rich in silver and gold, and this was discovered from Majescor’s recent prospects of Douvray, Blondin and Faille-B. However, the story could just as well be that the mining executives were biding their time and waiting for a “stable” non-nationalistic government to take effect before initiating their projects.

Indeed, the issue of gold mining could have been one of the undeclared motivations behind the February 2004 removal of Aristide. The post-coup government immediately went to work signing away Haiti’s mineral rights without any knowledge of the public. For example, the mineral rights to the SOMINE property were quietly assigned under a Mining Convention executed between this company and the coup government on May 5, 2005 and presumably valid until March 9, 2020. In any case, after the coup, Haiti’s mountains suddenly began to glitter. For example, an exploration of the Faille-B prospect in 2007 reported a gold vein that averaged 42.7 grams of gold per ton of ore (g/t) over 6 meters, including values of 107.5 g/t of gold over one meter.

According to Hachey, April 11, 2012 assays from Blondin found:

- 0.45 percent copper over 96.5 meters;

- 0.3 percent copper over 12 meters, including 0.61 percent copper over 1.5 meters; 154 grams of silver per ton (g/t) over 12 meters, including 869 g/t silver over 1.5 meters.

March 13, 2012 results from Blondin discovered:

- 72.4 g/t silver over 15 meters;

- 16.9 g/t silver over 113 meters, including 6.2 g/t silver over 1.5 meters; 0.43 percent copper over 113 meters, including 4.44 percent copper over 1.5 meters.

February 1, 2012 results from Douvray discovered:

- 255 g/t silver over 13.5 meters, including 2,069 g/t silver over 1.5 meters; 0.35 percent copper over 13.5 meters, including 0.52 percent copper over 1.5 meters; 0.02 g/t gold over 13.5 meters, including 0.04 g/t gold over 1.5 meters;

- 277 g/t silver over 13.5 meters, including 1,428 g/t silver over 1.5 meters; 0.18 percent copper over 13.5 meters, including 0.52 percent copper over 1.5 meters; 0.04 g/t gold over 13.5 meters, including 0.04 g/t gold over 1.5 meters.

These highly concentrated deposits of copper, silver and gold should reasonably represent a new found wealth for Haiti during a dire need of resources for the country’s reconstruction. But if the DR is to serve as an example, Haiti will not benefit from its minerals. In the DR, Barrick owns 60 percent of the Pueblo Viejo gold mine and Goldcorp Inc. owns the remaining 40 percent. To get a sense of the scale of the greed, one need only consider that, while gold currently costs over $1,700 per ounce, the Pueblo Viejo mine is slated to produce one million ounces of gold per year at a cost of only $20-50 per ounce, making it one of the lowest-cost gold mines in the world.

Hachey comments with evident enthusiasm: “What we’re most excited about is that we found some silver which was never really realized before. It’s the first silver discovery in Haiti…. Part of the reason why it was never really discovered was that historically there was so much copper prevalent — there’s a lot of outcropping at the surface. The people who did the work before did not do much testing, even for gold…. The geology is a little complex for a copper porphyry, but in a good way. The surprises that we’re getting are all good ones.”

As major draws for a big mining partner to this next phase of the project, Hachey is advertising that, unlike Port-au-Prince, which was destroyed by the earthquake, Cap Haitien is a pleasant place for a Canadian mining executive and his family to come to. In addition, he notes that there are plans for “the construction of a deep-water port at Caracol,” only 15 kilometres from the SOMINE property and near Cap-Haitien. Indeed, on May 7, 2012 Martelly announced that the construction of a port would soon start in Fort-Liberte (near Caracol), in the Northeast. The port will cost $179 million and is supposed to be “built with the U.S. government’s help,” but it will likely be entirely owned by U.S. concerns. This first official announcement of a deep-water port for Caracol explains in part why there has been no effort to mitigate the ecological effects of the massive free-trade (sweatshop) zone inaugurated in October 2012 in that area: the textile factories’ contributions to the degradation of Caracol Bay should be trivial compared to the damage from opencast gold mining and construction of a deep-water port.

UPDATES on December 21 and 28, 2012, Associated Press, VCS Mining. Under cover of the holidays, Haiti’s Mining Director Ludner Remarais issued a gold exploitation permit to VCS Mining LLC (and its wholly-owned subsidiary Delta Societe Miniere S.A.), a U.S. company based in North Carolina, and gold and copper exploitation permits to SOMINE S.A. SOMINE is 66.4 percent owned by Canada’s Majescor Resources Inc and 33.6 percent owned by a group of unidentified, and possibly nonexistent, Haitian investors. According to Majescor CEO Dan Hachey: the permit “allows us to finally produce and make money, at least get to that step…. It’s also a great step forward for the mining industry in Haiti.” SOMINE engineer Michel Lamarre said he expects exploration to start in 36 to 42 months, and VCS CEO Angelo Viard expects his company to enter into “production” within 29 to 38 months. The gold permits are for five years and renewable for up to 25 years, with a possible renewal for another 10 years if new resources are discovered. These permits were issued by Remarais without any environmental-impact assessment (EIA).

UPDATE on January 24, 2013, Defend Haiti. After a meeting of Haiti’s Senate Committee on Public Works and Communication, Minister of Public Works, Transportation and Communication Jacques Rousseau, and Director General of Mining and Energy Ludner Remarais on Tuesday, January 22, 2013, the Senate met and rejected the agreements made by Remarais with the U.S. and Canadian mining companies in December 2012, pending a review of the companies and the agreements.

UPDATE on April 10, 2014, Miami Herald. Plans to dig a deep-sea port in Fort-Liberte, near Haiti’s Caracol Bay area, have been scrapped. If the plans had gone ahead, they would have destroyed a rare hotspot of biodiversity in the Caribbean with Haiti’s largest remaining mangroves and such a breathtaking variety of corals that the area had been slated to become a World Heritage Site and marine park. Apparently the controversy around the project discouraged potential investors. Instead of destroying Fort Liberte Bay, the existing port in Cap Haitien will be expanded, despite its current operations being ten-fold under capacity.

UPDATE on March 5, 2015, Breitbart. The teaser to a new book titled Clinton Cash: The Untold Story of How and Why Foreign Governments and Businesses Helped Make Bill and Hillary Rich, by Peter Schweitzer, reveals that Hillary Clinton’s brother, Tony Rodham, as well as a former Haitian Prime Minister, Jean Max Bellerive, sat on the board of VCS Mining when it was granted its mining permit without an environmental impact assessment (EIA), under cover of Christmas 2012.

UPDATE on November 10, 2015 (Eurasian Minerals: http://www.eurasianminerals.com/s/haiti.asp). Under the cover of the Haitian elections, the US began to consolidate its mining interests in Haiti. The Canadian company, Eurasian Minerals Inc. (EMX) announced, on November 2, 2015, that it sold to the US mining company, Newmont Ventures Limited, all their joint-venture interests. Eurasian received $4 million (CAD $ 5.3 million) in cash from Newmont for the deal, along with a 0.5 percent net smelter return (NSR) royalty on 45 of the permit applications Eurasian got in the area. Eurasian will continue to control 100 percent of the Grand Bois gold-copper project in Haiti.

Editor’s Note: News Junkie Post co-Editor in Chief, Dady Chery, broke this story on May 2, 2012. She is the author of We Have Dared to Be Free: Haiti’s Struggle Against Occupation. Photograph one by Sky Truth; photographs two, five and six by United Nations Photo. Photograph four by Stormy Dog and photograph seven by Andrew Kuznetsov. Photographs eight, nine and ten by Alex Proimos.

Related Articles

8 Responses to Haiti’s Gold Rush: An Ecological Crime in the Making

You must be logged in to post a comment Login