The So-Called American Dream Has Become a Nightmare

By Tammy Marchand

Many families are still trying to rebound from what was their American dream. The good old American pie seems to have been harboring worms that upset the bellies of many Americans. While it is written that there is nothing new under the sun, one wonders if this statement had a final date at the point of inception, because no one has ever been down this path in recorded history. Americans have become pioneers in the new American nightmare, blazing rugged trails through economic frontiers that lead to who-knows-where.

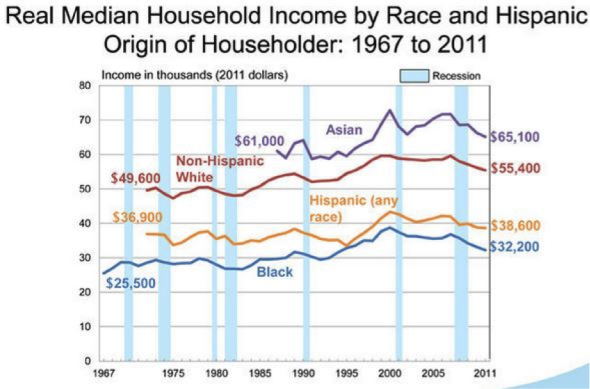

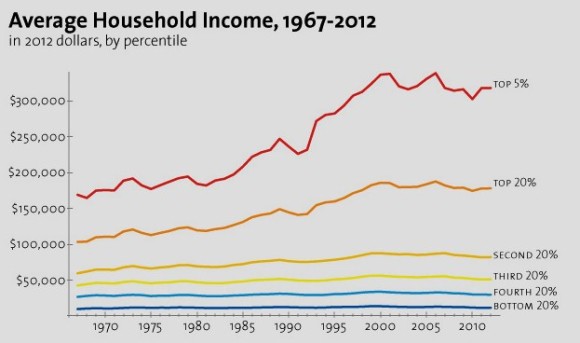

When you take a cross-section of the American pie, you see that it is not a pie but a layered fruit cake comprised of a diverse set of layers: Asian, non-hispanic white, hispanic, and black with slivers and remnants of native American. In an economic sense, no two layers are equal; yet the black and white layers are offset curves, identical in form, that have maintained roughly a $22,000 salary gap for the past 40 years. In these same 40 plus years after the Civil Rights movement, black Americans have wandered the wilderness, free to approach but barely able to scale the steep barriers to economic equality. Economic disparities between blacks and whites have been in a holding pattern for nearly a half century. Discrimination is alive and well under the hats and skirts of the United States.

While there is clear evidence of discriminatory lending against blacks and hispanics in the US in the mortgage industry, there is no mandate to monitor these practices in the realm of business loans. As of 2003, it became nearly impossible to track or prove discrimination in business lending. The Federal Reserve Board discontinued its report, called the Survey of Small Business Finances, which was the go-to report for measuring discriminatory business lending. Since families and businesses borrow from basically same lending institutions, we may assume that the practices in business lending are similar to those in the mortgage arena.

Discriminatory lending practices in the US still prevail, according to a study conducted by Devin Pope, Associate Professor of Behavioral Science at the University of Chicago Booth School of Business, and Justin Sydnor, Associate Professor at the Wisconsin School of Business, and titled “What’s in a Picture? Evidence of Discrimination, from Prosper.com”. Prosper.com is a peer-to-peer lending website where applicants are urged to include a personal photo to give the peer lenders a snapshot of perspective borrowers. The study found that on Prosper.com, black borrowers are 25 to 35 percent less likely to be funded than white borrowers with similar profiles. In traditional lending, hispanics and blacks are subject to higher interest rates, fees, and penalties than their white counterparts with equivalent incomes and credit scores.

Over the past decade, the American dream has morphed into the American nightmare for many. When it comes to black-American owned businesses versus those owned by any other group, no two nightmares are equal. As a rule, the black-American nightmare yields greater economic distress and starts from a more disadvantaged position compared to non-black counterparts. Discriminatory lending, poor debt-to-income ratios, underfunded start ups, and low levels of generational business ownership are just a few of the conditions that handicap black-owned businesses even before they begin.

One example of such a nightmare is a once-successful landscaping business in Atlanta, Georgia. The Cooper family were fortunate enough to launch their business with their savings, an existing clientele, and generational business experience. Mr. Cooper had some college and extensive experience in the landscape-maintenance industry: enough to launch the family’s landscape-maintenance business. The business became such a success that Mrs. Cooper, who is college educated and held a corporate job in computer-applications support, resigned from this position to manage the family’s company. After 14 years of consistent growth, the unthinkable happened: Mr. Cooper fell ill for an eight-year time span, in tandem with the housing market crash and the recession. The business plummeted into an unforgiving financial zone to which most lenders and investors would not risk extending credit: a death sentence for a black-owned business.

When faced with situations out of one’s control, the challenges balloon exponentially for small black-owned businesses. The Cooper’s landscape business survived the first five years of Mr. Cooper’s illness on the family’s reserve funds. Nevertheless, without oversight of the field operations, quality control became a major issue. The deterioration of the manicuring services they once provided resulted in their inability to make a profit.

A black-owned business with bad credit and damaged resources, compounded by a crippled economy, is a formula for death without resurrection. What are the options for black entrepreneurs in these situations? The Coopers were forced to search for creative methods to finance their restart. After brainstorming with friends and family, they turned to crowdfunding.

The lending industry needs to look more closely at its immoral practices, which appear to be natural fibers of the American way that define the US as the land of perpetual inequality. Until a lending model with faceless borrowers is developed, this worm will remain a permanent resident in the American pie.

Editor’s Notes: Tammy Marchand is a social entrepreneurial consultant who works with nonprofits, individuals, and small businesses in creative marketing, business development, and financing on shoestring budgets. She holds an MBA from the University of Chicago Booth School of Business. Photographs one and eight by Lotus Carroll. Photographs four, five and seven by Mike Licht and photographs three and six by Jeffrey Smith.

Related Articles

4 Responses to The So-Called American Dream Has Become a Nightmare

You must be logged in to post a comment Login