Free Market Capitalism: A Bipolar Vicious Cycle of Boom and Bust

What most economists are still calling “The Great Recession” officially started in December 2007. However, the global financial meltdown started a bit later, in the fall of 2008, in the United States. Calling this massive global crash “recession” was always an understatement made to avoid a complete global panic. A more accurate term would have been to call it the 2ND Great Depression, which almost all financial “experts” and policy makers failed to diagnose and treat as such.

On June 27 2008, I wrote an article for another publication untitled: “Are We Heading For A World Wide Depression Worse Than 1929?”. At the time, most readers found my forecasts “alarmist” or even disconnected with reality. However, it turned out that I was a lot less off mark than most economists or journalists covering financial topics on the issue of the looming crisis. In retrospect, what I find the most alarming, especially because I don’t claim to be a financial expert, is the fact that so few people saw the runaway train of the financial crash coming.

Most Americans, either Republicans or Democrats, are still fervent advocates of the Free Market concept of capitalism. “The Market Knows Best” is still their motto and the corner stone of a crumbling US economy. Americans are still accepting the pathological cycles of boom and bust, which are a direct correlation of the free market, as unavoidable as paying taxes or death. The collapse of late 2008 was a perfect opportunity to reconsider these foolish notions, and to put this blind and irrational reliance on free-market-is-king on trial.

However, almost at mid-term, the Obama administration has failed to address any of the systemic issues at stake in the matter, and to make things worse globally, the European Union is now on the brink of insolvency with Greece, Spain, Portugal and Ireland in the “lead”. In the US, the so called finance reform bill is not a game changer but mere window dressing. The bill was passed too late and should have been implemented before the huge bail out was given to Wall Street, with almost no strings attached, instead of a few weeks ago when most of the TARP funds were supposedly paid back to US tax payers.

This bad timing on the part of the Obama administration and Democrats in Congress made any real leverage on financial institutions disappear. If nothing else, the financial collapse and the massive bail out from the Federal government made the financial institutions deemed “too big to fail” even bigger. Before and during the collapse, Bank Of America bought Countrywide, Morgan Chase took over Washington Mutual and Wells Fargo bought Wachovia. And of course, bigger banks translate in less option for consumers, less competition and tighter credit.

Of the three last big banks still standing (B of A, Chase and Wells Fargo), Chase is the one with the most dubious practices. Chase is currently facing several Class A legal actions for being completely uncooperative and even deceptive in working with distressed homeowners in restructuring their loans. They do not return calls, shuffle people around from one division to another and, last but not least, “lose” loan documents as a policy in what amounts to a financial version of Kafka’s “The Castle”. On the credit side, Chase has been putting a squeeze on consumers relentlessly. For example, until August 2009 my line of credit with Chase was at $35,000. The first thing Chase did was to double my minimum payment while lowering, by increments, my credit line which know stands at $21,000.

Some people are wondering why Wall Street’s recovery is not translating into a recovery for main street, but it is rather simple to understand: Banks are not eager to lend and corporations, which are doing well and showing large quarterly profits, are not hiring. Instead, both banks and corporation are focusing on accumulating large cash reserves. The latest boom in the US economy, which ended in 2007, was fueled by speculation on real estate value and consumer spending. In our current grim “new economy”, as defined by the proponents of jungle-free-market-capitalism, we are all supposed to show restraint and are asked to “tighten our belts”. Just like banks and corporations, wealthy Americans are sitting on their considerable assets and are ruled by fear. On the other hand, the dwindling middle-class is quickly becoming insolvent with almost no way out, and certainly unable to tighten any belts.

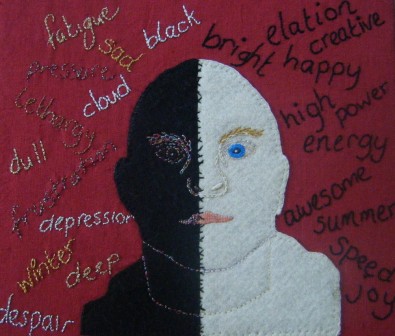

If America was an individual, it would likely be diagnosed as suffering from untreated bipolar disorder with the boom parts of the cycle as manic episodes and the bust as depression. From the late 90’s up to 2007 the euphoria of mania was running the psyche of most Americans. Since then, in just three years our global consciousness has reached rock bottom, with constant anxiety, fear and a deep sense of loss floating over our heads like the sword of Damocles. Yet, the advocates of free market economy are still viewing the manic-depressive cycles of boom and bust as a “normal” and almost natural phenomenon. The therapy to “heal” America’s psyche might have to be a work in progress, but the alternative of free market shock capitalism is clearly not working out for most Americans. In order to be on track for a sustainable economic recovery we must first put in question the sacrosanct dogma of free market and its manic-depressive manifestation of the boom and bust cycles.

Related Articles

5 Responses to Free Market Capitalism: A Bipolar Vicious Cycle of Boom and Bust

You must be logged in to post a comment Login