The Slavery Of Debt: Leave Home Without Your Amex, Visa And MasterCard

Predatory global capitalism is still running amok on the global economy. Several countries in the European Union are on the verge of complete insolvency. Ireland had to be bailed out by other richer EU members and was strong armed into accepting a budget austerity plan from the IMF. A few months ago, it was Greece. All financial analysts are predicting that the next victims of shock capitalism’s domino effect will be Portugal and Spain, with Italy as a likely candidate to follow.

Some European countries such as Britain and France are trying to implement various austerity plans to deal with budget deficit and huge national debts. The austerity measures; such as raising retirement age and cutting social benefits have encountered strong opposition from workers, government employees and Europe’s middle class in general. Despite the strong opposition taking place in the streets and work places, European governments are moving ahead and implementing policies of tax increase and spending cuts.

Meanwhile, on the other side of the Atlantic, the United States is heading into a complete different direction by betting on tax cuts instead of tax increases despite the fact that for every one dollar spent by the federal government 40 cents is borrowed. But one thing Americans can count on, once the new GOP controlled House of Representatives is seated, are drastic cuts on critical federal social services and programs. The same phenomenon is already taking place at local and state levels. Across the nation, cities and states are cutting down on essential social services for the poor and even on police and firefighters. California, the most populous and one of the so called “richest” states in the nation has a budget shortfall of $19 billion. California, just like so many states across the nation is on the verge of bankruptcy, yet we are told that the recession is officially over.

During the boom, fueled by the global real estate bubble engineered by casino capitalism, borrowing was easy for countries such as Iceland, Greece, Ireland and for individual borrowers both in Europe and the United States. In the last 10 years, many of us bought houses we couldn’t really afford. People were sold, by their favorite banksters, on the premise that the value of their investment would keep increasing forever. To add insult to injury, financial institutions pumping all these loans for properties which they knew were overvalued, were also pushing others financial “weapons of mass destruction” such as equity line of credit, personal line of credit, and of course credit cards.

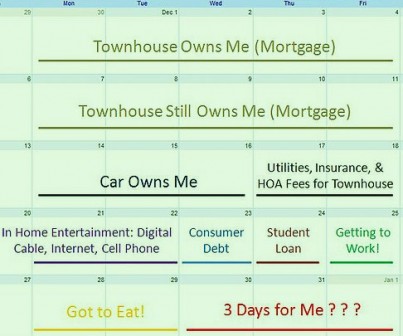

The so called prosperity of the economic boom, which spanned from the late 90s to 2008, was merely an illusion for most people. While the top executives of global finance acquired an obscene wealth, the rest of us became slaves of our respective debt. The financial sector operated like a clever drug dealer: the few first “fixes” were free until buyers were fully hooked. Most of us became addicted to borrowing. People took a second loan on their already overvalued properties, and had three or four credit cards borrowing on one to pay the other. In other words, Wall Street and other financial markets concentrated wealth at the top while engineering and dumping an insurmountable amount of debt on all of us.

This highly dysfunctional system came to a halt in late 2008, and since then banks took a drastic turn and are not eager to lend anymore. Qualifying for a loan to buy a house is incredibly difficult with lenders appraising properties a lot lower than market price. Credit card companies have lowered the available credit for most of their customers, and are not aggressively seeking new credit addicts like they used to do.

However, this is likely to be temporary. Very soon your mail box will be flooded again by all kind of offers from American Express, Visa, MasterCard etc. peddling some new products with teaser rates and offers which seem too good to be true. This time around, consumers should not be fooled and conned by lenders into believing that one can spend now and pay later. Despite the shortfall of our respective governments, there are quite a few things we can do on an individual level to break the chains of debt slavery.

Firstly, if you carry a high balance on any credit card you should pay it off as soon as possible even if you have to use some of your money from a saving account (providing you have any). Your money saved in money market accounts, savings or CDs is just sitting there earning a negligible interest while the interest rate you are currently paying on your credit card is likely to be at least 10 times higher.

Secondly, consolidate the plastic you carry in your wallet to one. Once you have brought down the balance on your credit card to almost zero, then start using your card again but make sure you pay the complete balance off every month. If you use a credit card that way, and don’t overcharge on any given month, you will pay a negligible amount in interest.

Thirdly, consumers should use cash as much as possible. Once you start this process, you will realize that you are becoming a smarter shopper. Give yourself a weekly budget for food, gas etc and take money out of your checking account. If you start doing so, and keep your credit card in your wallet, or even better at home, it will be your first step to free yourself from the addiction of borrowing. Giving the finger to your favorite banksters will be the icing on the cake of this process of taking control of your financial life.

Related Articles

5 Responses to The Slavery Of Debt: Leave Home Without Your Amex, Visa And MasterCard

You must be logged in to post a comment Login

Pingback: The Slavery Of Debt: Leave Home Without Your AmEx, Visa And MasterCard

Pingback: === popurls.com === popular today