Consumerism Schizophrenia: Consumer Spending Up, Consumer Confidence Down

NEWS JUNKIE POST

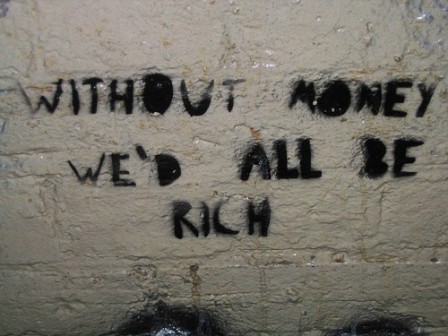

Dec 30, 2010 at 1:17 pmThe 2010 holiday season was good for retailers in the United States as Americans are back on a shopping spree, often buying what they don’t really need, and foremost what they can’t afford unless they put themselves further in debt. Despite the recession, consumerism is still America’s favorite addiction. But strangely enough, while consumer spending was up to a level similar than the one before the global financial meltdown of 2008, the Consumer Confidence Index fell in December, and is currently scoring at a very low 50 percent. As an indication, in periods of economic prosperity, the index is at around 90 percent. Is this trend, yet another confirmation of the fundamental irrationality of consumerism when people who are worried about the economy are spending more? Or is consumerism a way for Americans to cope with their deep anxiety?

MasterCard was reporting two days ago that sales from early November through Christmas Eve were up 5.5 percent from last year. Sales were especially strong for luxury good items and jewelry, which obviously means that rich people are feeling “bullish” about their own financial predicaments, if not about the overall economy. Two very different realities are at play in the current dysfunctional US economy: On one hand, for the few individuals beneficiary of the vast and fast growing transnational corporate wealth, the recession is over; on the other hand most Americans are still victims of the Great Recession, and can barely make ends meet.

The fact that consumer confidence is down is anchored in the reality experienced by an overwhelming majority of Americans: The housing market is very bad with real estate values still eroding nationwide; the unemployment rate remains at around 10 percent; gas prices are skyrocketing and some analysts say it could pass $5 a gallon in 2011. However, and this is the only good news in the economic forecast, the stock market is doing well.

So once again, we have this big and unsustainable social dichotomy. For the well off few, with investments on Wall Street, it is the “best of times” while for the majority of Americans, it is still the “worst of times”. The United States has now two separate economies moving on completely different tracks in a form of economic apartheid (separate and unequal) between transnational corporate interests on one side and everyone else on the other. And while it is “good times” again for mega-corporations and the wealthy at the top, 2011 is likely to have more despair and misery in store for most Americans.

In 2010, big corporations made giant profits focusing on the expanding markets of China, India and other fast growing emerging economies. Meanwhile, the same corporations, sitting on large cash reserves, are still cutting down on their US operations and are not hiring US workers. For example, General Motors, a company bailed out by the Obama administration with US taxpayers’ money, is now making more cars in China than in the US. General Electric is keeping its payroll down in the US, but will invest $ 2 billion in China and $500 million in Brazil, in a venture that will not create any jobs in the United States but instead 1,000 jobs in Brazil.

Related Articles

- November 23, 2012 Occupy Strategy: Global Strike and Consumer Boycott Should Be on the Agenda

- September 3, 2010 Great Recession: Are War Spending And Wealth Concentration To Blame?

- February 22, 2011 America: In God We Trust, But Money We Worship

- June 24, 2010 Global Trend: The Rich Are Getting Richer

- August 2, 2010 Free Market Capitalism: A Bipolar Vicious Cycle of Boom and Bust

- January 19, 2011 America: No Vacation Time For You

8 Responses to Consumerism Schizophrenia: Consumer Spending Up, Consumer Confidence Down

You must be logged in to post a comment Login

Pingback: Consumerism Schizophrenia: Consumer Spending Up, Consumer Confidence Down