Is America Already Bankrupt?

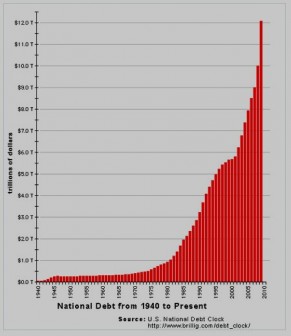

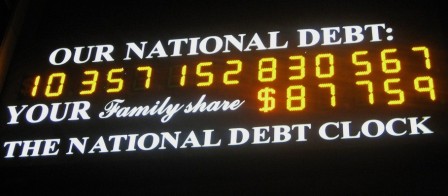

The United States national debt has passed $14 trillion. For each dollar spend by the federal government 40 cents is borrowed. So technically, the US is already bankrupt because it has a debt that is almost four times the size of its economy. Lawmakers in Congress are saying that their major priority is to tackle and find ways to reduce the national debt, yet they are unwilling to see that the only way to avoid fiscal insolvency is to have a dual approach: Cut spending on one hand, and increase taxation on the other. Short of this, the United States will never get out of this giant hole that it has dug for itself. During his state of the union speech, President Obama said that we need a new “sputnik moment”. America’s sputnik moment should be to make drastic cuts in its military spending by getting the US military out, sooner than later, of Afghanistan, Iraq, Germany, Japan and South Korea.

Cut Spending AND Increase Taxes Or Face Dire Consequences

Not only the US is in deep financial troubles federally, it is also in dire shape at state and local levels. 44 states are currently facing big budget gaps, and some are even considering bankruptcy as a way out. America’s policymakers are facing the daunting task to tackle a dreadful fiscal challenge. The 2008 recession has caused the sharpest decline in state tax revenue on record with state tax collections at 12 percent below pre-recession level. Meanwhile, the need for state funded services has increased. Even after making deep budget cuts, especially in social services, over the last three years, states are now facing what seems to be insurmountable budget gaps.

Fiscal 2012 is projected to be the most difficult year on record with 44 states and the District Of Columbia projecting a budget gap totaling $125 billion. States options for addressing those budget gaps are dwindling fast. By the end of fiscal year 2011, federal assistance for states will be largely gone. State governors are now faced with a grim reality to prevent their fiscal house to become completely underwater.

On Tuesday, New-York state Governor Cuomo declared the state “functionally bankrupt”. Cuomo is proposing a $132.9 billion budget that would make drastic cuts on education and health care. Despite the cuts, the projected budget shortfall for the state of New-York for fiscal 2012 stands at $9 billion. In Governor Cuomo budget proposal, Medicaid programs and school would each be cut by $2.85 billion. If Cuomo is heading towards cuts on social services for the people who need it the most, in California, Governor Brown has a different approach. Brown is running out of ways to make budget cuts which were already made by his predecessor, and he wants to extend tax increases to balance California’s budget. Governor Brown has the intention to take the issue directly with California voters. Brown said it is a tough budget, but that people have the right to vote on his budget package.

“When democratic ideals and calls for the right to vote are stirring the imagination of young people in Egypt and Tunisia and other part of the world, we in California can’t say now is time to block a vote of the people. If you are a Democrat who doesn’t want to make budget reductions in programs you fought and deeply believe in, I understand that. If you are a Republican who has taken a stand against taxes, I understand where you are coming from. But this time things are different. In fact, the people are telling us- in their own ways- they sense something is profoundly wrong,” said Brown.

Despite this dreadful reality, the Center on Budget and Policy Priorities (CBPP) is trying to diffuse the situation by calling the depiction regarding catastrophic states debt “alarmist”. The CBPP says that recent articles regarding the fiscal situation of states and localities have lumped together the current fiscal problems, due to the recession, with long terms structural problems such as debt in relation to pension and retirement obligations. But will states have to declare bankruptcy? Some policymakers are suggesting that federal laws should be enacted to allow states to declare bankruptcy. By doing so, it would give them the possibility to default on their bonds, pay vendors less than they are owed, and modify or even cancel union contracts.

Historically, we have to go back to the civil war when several states defaulted on their debt obligations. During the Great Recession, only Arkansas defaulted on its debt. The CBPP argues that such bankruptcy move would be “unwise”, and adding that “States have adequate tools and means to meet their obligations”. The CBPP also points out that “it could push up the cost of borrowing for all states, undermining efforts to invest in infrastructure.”

Related Articles

4 Responses to Is America Already Bankrupt?

You must be logged in to post a comment Login