Foreclosure Scam: How the Banks Always Win

NEWS JUNKIE POST

Nov 25, 2011 at 10:20 am The foreclosure crisis in the United States is not showing any signs of slowing down. Almost no regions and cities of the country are immune from it. The real estate debacle is affecting every region especially Florida, Nevada, Arizona and Michigan. Detroit and Las Vegas can be considered the two metropolitan areas which have been hit the hardest. In the “Motor City”, which used to be the crown jewel of American manufacturing for a century, one can buy a decent house for $25,000. Vast areas of Detroit look like a futuristic no-mans land: an accurate depiction of capitalism’s advanced decay.

The foreclosure crisis in the United States is not showing any signs of slowing down. Almost no regions and cities of the country are immune from it. The real estate debacle is affecting every region especially Florida, Nevada, Arizona and Michigan. Detroit and Las Vegas can be considered the two metropolitan areas which have been hit the hardest. In the “Motor City”, which used to be the crown jewel of American manufacturing for a century, one can buy a decent house for $25,000. Vast areas of Detroit look like a futuristic no-mans land: an accurate depiction of capitalism’s advanced decay.

In Las Vegas, “for sale” signs are everywhere with an overwhelming majority of the properties being bank owned. Properties which used to sell for $350,000 before the 2008 crash are now selling for $150,000. In Phoenix Arizona, the situation is even worse. Investors with cash, either foreign or domestic, are taking advantage of the bargains. Canadians and Germans are buying condos in Florida, attracted by the climatic appeal. An American investor explained to me his overall strategy. He wouldn’t touch any properties in Detroit, which he views as “doomed”, but he is currently buying houses in Nevada and Florida. His plan is fool proof because of its simplicity. He buys foreclosed properties for cash, then does a minimum of repairs, as needed, and just rents them. He is gambling that the market will eventually pick-up and he will then sell the properties for a substantial profit.

In Las Vegas, “for sale” signs are everywhere with an overwhelming majority of the properties being bank owned. Properties which used to sell for $350,000 before the 2008 crash are now selling for $150,000. In Phoenix Arizona, the situation is even worse. Investors with cash, either foreign or domestic, are taking advantage of the bargains. Canadians and Germans are buying condos in Florida, attracted by the climatic appeal. An American investor explained to me his overall strategy. He wouldn’t touch any properties in Detroit, which he views as “doomed”, but he is currently buying houses in Nevada and Florida. His plan is fool proof because of its simplicity. He buys foreclosed properties for cash, then does a minimum of repairs, as needed, and just rents them. He is gambling that the market will eventually pick-up and he will then sell the properties for a substantial profit.

There are indeed plenty of opportunities for the investor sharks taking advantage of the crisis. The name of the game is cash readily available. This is the way the real estate market is getting “cleaned up”. But overall the big beneficiary of all this are still the banks. The foreclosure scam, it should be called as such, had three different phases. In each one of them, the banks made a remarkable profit.

There are indeed plenty of opportunities for the investor sharks taking advantage of the crisis. The name of the game is cash readily available. This is the way the real estate market is getting “cleaned up”. But overall the big beneficiary of all this are still the banks. The foreclosure scam, it should be called as such, had three different phases. In each one of them, the banks made a remarkable profit.

Phase One: Inflate the Value of the Housing Market

Between 1998 and 2008, the “value” of real estate in America was going through the roof. The inflation was created by the banks. At the time as we remember, “everyone with a pulse” could get a loan. Stated income was perfectly acceptable, as well as almost “no money down” loans. It was a gold rush, and a lot of people got conned into the banks’ game. Appraisers, working for the banks, would over estimate the value of properties. Independent mortgage brokers also saw an opportunity to make a lot of money in this process. Eventually all the loans, with many shaky ones, will get re-bundled in what was supposed to be AAA rating investment.

Phase Two: Burst the Bubble and Create a Panic in Order to Get Money from the Taxpayers

Phase Two: Burst the Bubble and Create a Panic in Order to Get Money from the Taxpayers

This was of course the bank bailout during the fall of 2008, during the transition between the Bush administration and the Obama administration. In the process, banks scammed the US taxpayers of more than 700 billion. They created a panic, on the premise that the “sky was going to fall” on all of us if they didn’t get this cash flow. Banks took advantage of this windfall by going on a shopping spree. Wells Fargo bought Wachovia, while Chase purchased Washington Mutual.

Phase Three: Foreclose on Homeowners and Sale for Cash

Phase Three: Foreclose on Homeowners and Sale for Cash

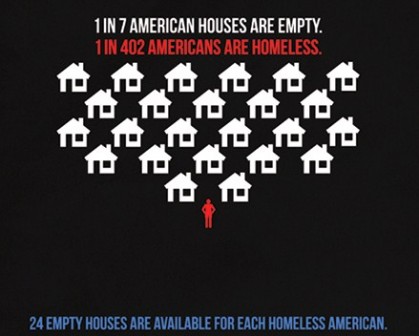

This is the phase which we are still in. Despite countless promises, the Obama administration is still doing nothing to stop this phase. People bought overvalued- by the banks- properties and are now “owning” a piece of real estate that is worth less than the loan. They have two options: either a short sale and they can walk away with nothing or, if they don’t want to let go of their properties, they can face the slow and painful process of foreclosure. Regardless, in the medium terms, they will get kicked out of their houses. Anyone with any knowledge about gambling is fully aware that the “house always wins”. This applies with the banks, the dice were loaded from the get go, and the banks still have the upper hand.

Related Articles

- October 21, 2012 Foreclosures: The Scam Continues

- October 8, 2010 Foreclosure Crisis: Homeowners Take On Banksters In California

- June 19, 2011 Are We Heading For A Bigger Global Financial Crash Than 2008?

- July 21, 2010 Real Estate: The Sharks Are Back Working Inside Deals With Banks

- August 2, 2010 Free Market Capitalism: A Bipolar Vicious Cycle of Boom and Bust

- November 23, 2012 Occupy Strategy: Global Strike and Consumer Boycott Should Be on the Agenda

2 Responses to Foreclosure Scam: How the Banks Always Win

You must be logged in to post a comment Login